BLOG

WHY DOES THE STOCK MARKET GO UP AND DOWN?

- By theinvestmentcompass

- •

- 09 Oct, 2015

Ever wonder why the stock market or bonds or commodity prices move up and down?

Nearly everyone spends a lot of time looking to find a reason. And, if you look hard enough you will almost always find any number of reasons “why” it happens.

As Bigfork’s leading financial advisor, my favorite answer to the question, “Why?”, however, is the one an early mentor taught me.

“The answer to the ‘Why?’ question”, he would say,”deserves the cosmic booby prize – it doesn’t really matter why,” he went on to conclude, “it simply is.”

I understand that answer. However, lots of folks want something more definitive.

And, the good news is that in the case of why stock, bond and commodity prices moving up and down, there is an answer to the “Why?” question.

Actually, the price of anything, including stocks, bonds and commodities, moves up or down because of The Law of Supply and Demand.

Nothing more and nothing less!

When there are more buyers than sellers of a stock, the price has to move up. Conversely, when there are more sellers than buyers, the price has to move down.

It’s The Law!

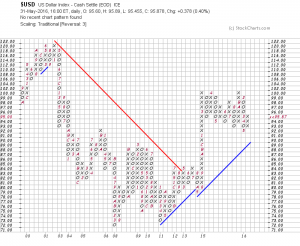

The best news of all is that there are Point-and-Figure (PNF) charts that pictorially show when, and at what price, there is a predominance of buyers or sellers.

With the PNF chart at our side, investors can make an informed investment decision.

Making an informed decision is every investor’s goal. With the help of a skilled financial advisor like Mr. Terry Atzen of Bigfork’s The Investment Compass, you can navigate the ups and downs of the stock market to maintain a winning portfolio.

Weighing-In on Gold and Silver……..What’s the Real Truth

In the past few weeks, I have been amazed by the extreme range of predictions on the price of Gold and Silver (Harry Dent [ www.economyandmarkets.com ] says $750 and Jim Rickards [ www.silverdoctors.com/Jim-Rickards ] says $10,000), so I decided to weigh-in on the subject (without the predictions!).

Let me say first, that this is a great example of why I wrote my book and why I do the work that I do.

Pundits can, and do oftentimes confuse investors. This creates doubt and causes investors to ask, “Who do I believe? Who is correct? “What is the Truth?”, and as the result, end up doing nothing when their personal instincts say otherwise.

My work is about “What Is” – logical, simple and easy to understand.

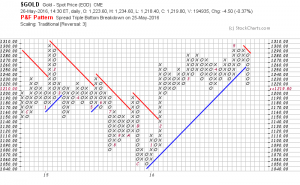

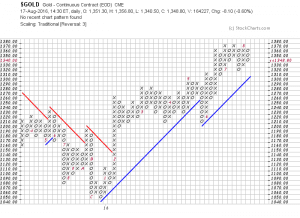

As usual, my analysis begins with an index, in this case, the Index for each of the metals, then the respective ETFs as well as the Inverse ETFs for verification.

And, at the end of this blog, I will take a look at the Gold/Silver ratio that many folks like to monitor.

First, the Gold Index: