BLOG

WHEN IS IT TIME TO HIRE A FINANCIAL ADVISOR?

- By theinvestmentcompass

- •

- 15 Oct, 2015

Here at The Investment Compass, Mr. Atzen is one of America’s most innovative investment coaches. He can help you navigate the market with his 50 years of experience and insights as your guide. While nearly everyone could benefit from working with a professional financial planner, the cost is often prohibitive. There comes a time, however, when paying for financial advice becomes a solid investment in your future. How do you know when it’s time to hire a financial advisor?

In a perfect world, everyone would have financial advisors with whom we could check in once a month or call before making a big purchase or investment decision. While some people view financial advisors as expensive, it’s simply because advisors have to charge a certain amount to make a living doing what they do. As a result, the decision to hire a financial advisor requires a careful cost/benefit analysis. What does it cost, and what do you expect to get in return?

It varies, but most fee-only financial planners will charge between $1,000 and $2,000 for a comprehensive financial plan. Here at The Investment Compass, our most comprehensive and innovative financial planning only cost you $360 a year!

Everyone is in a different place in their life. Here are three reasons to hire a financial advisor:

You’re feeling lost in planning for your financial future and you need a roadmap

You just can’t deal when it comes to money. You’re not the DIY type and you simply want a professional to take care of everything for you.

You like managing your money, but realize that your financial plan would benefit from an impartial and unemotional third-party opinion.

Weighing-In on Gold and Silver……..What’s the Real Truth

In the past few weeks, I have been amazed by the extreme range of predictions on the price of Gold and Silver (Harry Dent [ www.economyandmarkets.com ] says $750 and Jim Rickards [ www.silverdoctors.com/Jim-Rickards ] says $10,000), so I decided to weigh-in on the subject (without the predictions!).

Let me say first, that this is a great example of why I wrote my book and why I do the work that I do.

Pundits can, and do oftentimes confuse investors. This creates doubt and causes investors to ask, “Who do I believe? Who is correct? “What is the Truth?”, and as the result, end up doing nothing when their personal instincts say otherwise.

My work is about “What Is” – logical, simple and easy to understand.

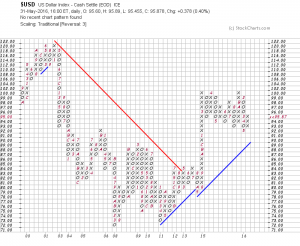

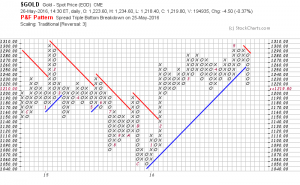

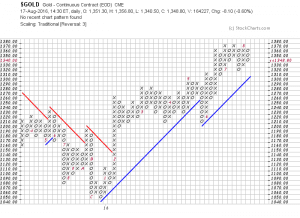

As usual, my analysis begins with an index, in this case, the Index for each of the metals, then the respective ETFs as well as the Inverse ETFs for verification.

And, at the end of this blog, I will take a look at the Gold/Silver ratio that many folks like to monitor.

First, the Gold Index: