BLOG

WHAT DOES PHYSICS HAVE TO DO WITH INVESTMENTS?

- By Terry J. Atzen

- •

- 20 Oct, 2015

Remember high school physics and learning about Newton’s Law of Motion?

Mr. Richardson, my high school physics teacher, would be very proud of me for remembering after all these years, despite my seemingly unrelated career of providing investment advice in Bigfork, Montana.

Well, Newton’s First Law of Motion (sometimes called the Law of Inertia) states that an object at rest stays at rest and an object in motion stays in motion with the same speed and in the same direction unless acted upon by an unbalanced force.

It is my observation that the same principal generally applies to the motion and direction of investments whether they are stocks, bonds, gold, currencies, real estate and other market investment vehicles, it works the same way.

In the case of investments it is either the buyers or the sellers that act as the “unbalanced force”.

When there are more buyers than sellers, the “unbalanced force” creates an uptrend (motion) in the price of whatever the investment vehicle is.

When there are more sellers than buyers, the “unbalanced force” creates a downtrend (motion) in the price of whatever the investment vehicle is.

The previous two paragraphs describe yet another law: The Law of Supply and Demand.

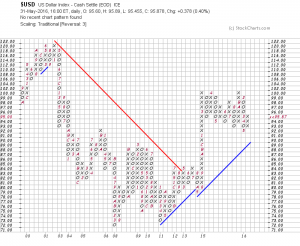

Investors are in luck since we have an investment tool that specifically and accurately depicts the Law of Supply and Demand – they are called Point-and-Figure (PNF) Charts.

The unbiased PNF chart shows us when buyers are more prevalent than sellers – and vice versa – and also show us where there is support and resistance with any investment. As an investment coach, I recommend that PNF charts be continuously monitor with all of the investments in your portfolio.

There are several websites that teach investors about these amazing charts. My favorite is www.stockcharts.com where they have daily updated PNF charts as well as a wonderful course (free) to teach investors how to read and interpret PNF charts.

For more information, please contact my Bigfork office or visit my website: www.theinvestmentcompass.com

A place where physics and investment advice join forces.

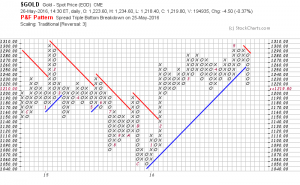

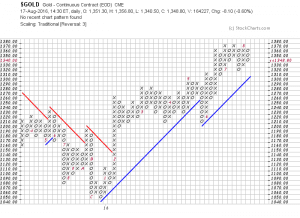

Weighing-In on Gold and Silver……..What’s the Real Truth

In the past few weeks, I have been amazed by the extreme range of predictions on the price of Gold and Silver (Harry Dent [ www.economyandmarkets.com ] says $750 and Jim Rickards [ www.silverdoctors.com/Jim-Rickards ] says $10,000), so I decided to weigh-in on the subject (without the predictions!).

Let me say first, that this is a great example of why I wrote my book and why I do the work that I do.

Pundits can, and do oftentimes confuse investors. This creates doubt and causes investors to ask, “Who do I believe? Who is correct? “What is the Truth?”, and as the result, end up doing nothing when their personal instincts say otherwise.

My work is about “What Is” – logical, simple and easy to understand.

As usual, my analysis begins with an index, in this case, the Index for each of the metals, then the respective ETFs as well as the Inverse ETFs for verification.

And, at the end of this blog, I will take a look at the Gold/Silver ratio that many folks like to monitor.

First, the Gold Index: