BLOG

CORRECTION AHEAD? ANSWER: ONLY IF THERE ARE MORE SELLERS THAN BUYERS.

- By Terry J. Atzen

- •

- 29 Apr, 2015

Among the many stories in today’s news I came across the following headline: “Correction ahead? Investors exit stocks despite new records”

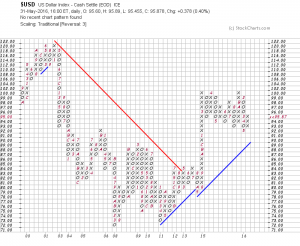

And, it has the below chart to illustrate its point.

“Hmmm”, I thought.

Then two questions came to mind:

1. “Are these mutual fund outflows? (Answer: Yes) And, aren’t they mostly wrong? (Answer: Yes)”

and,

2. “If fund liquidation is taking place, who is taking the S&P 500 to new highs?”

Those of you that have followed the work at The Investment Compass (www.theinvestmentcompass.com) know that if a stock or an index of stocks, like the S&P 500, it doesn’t really matter “who” is buying, the fact is that there are simply more buyers than seller.

It’s as simple as that!

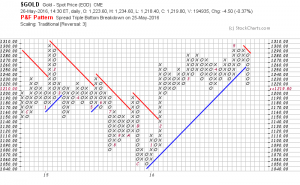

Somebody is buying and there are more of them (buyers) than sellers which is seen in the point-and-figure chart of the S&P 500 seen below, thanks to StockCharts.com.

Remember, the only thing a point-and-figure chart illustrates the prevalence of buyers and sellers, it doesn’t tell us who is buying (or selling).

$SPX – Graphical P&F – Charting Tools – StockCharts.com

And, maybe the first chart (Chart 1) seen above is really good news for the market since mutual funds are generally wrong. However, to their credit, it is the investor in the mutual fund that is selling and not the management of the fund that is creating the outflow of funds.

So unless the mutual fund investors withdrew their funds, wouldn’t that mean the mutual fund would have cash and therefore have increased buying power?

Just sayin’.

Weighing-In on Gold and Silver……..What’s the Real Truth

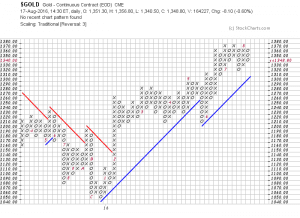

In the past few weeks, I have been amazed by the extreme range of predictions on the price of Gold and Silver (Harry Dent [ www.economyandmarkets.com ] says $750 and Jim Rickards [ www.silverdoctors.com/Jim-Rickards ] says $10,000), so I decided to weigh-in on the subject (without the predictions!).

Let me say first, that this is a great example of why I wrote my book and why I do the work that I do.

Pundits can, and do oftentimes confuse investors. This creates doubt and causes investors to ask, “Who do I believe? Who is correct? “What is the Truth?”, and as the result, end up doing nothing when their personal instincts say otherwise.

My work is about “What Is” – logical, simple and easy to understand.

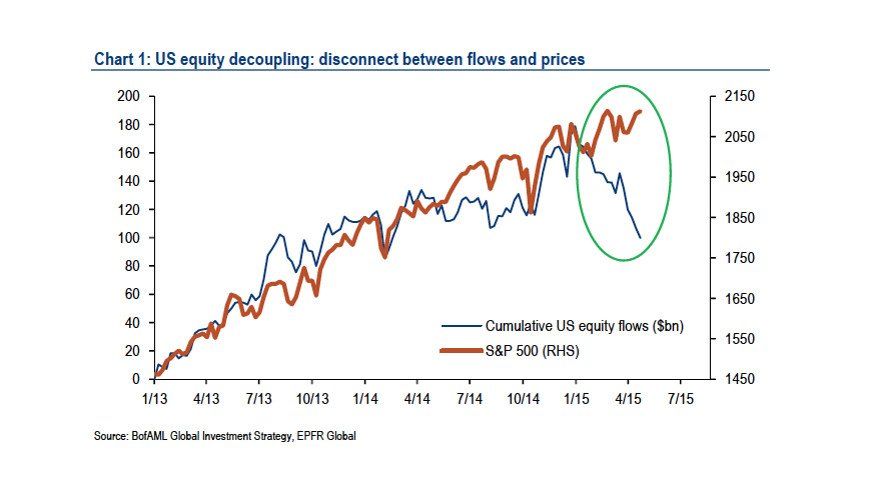

As usual, my analysis begins with an index, in this case, the Index for each of the metals, then the respective ETFs as well as the Inverse ETFs for verification.

And, at the end of this blog, I will take a look at the Gold/Silver ratio that many folks like to monitor.

First, the Gold Index: